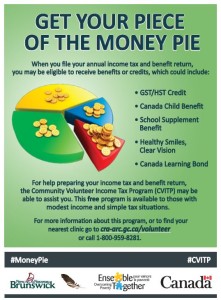

The Economic and Social Inclusion Corporation of New Brunswick (ESIC), in partnership with the Canada Revenue Agency and Service Canada are hosting 7 Money Pie Super Clinics to help low income New Brunswickers file their taxes, get their children a Social Insurance Number, and sign them up for the Canada Learning Bond in one easy step. At the Super Clinics, participants can also learn about other provincial and federal programs and benefits for their families.

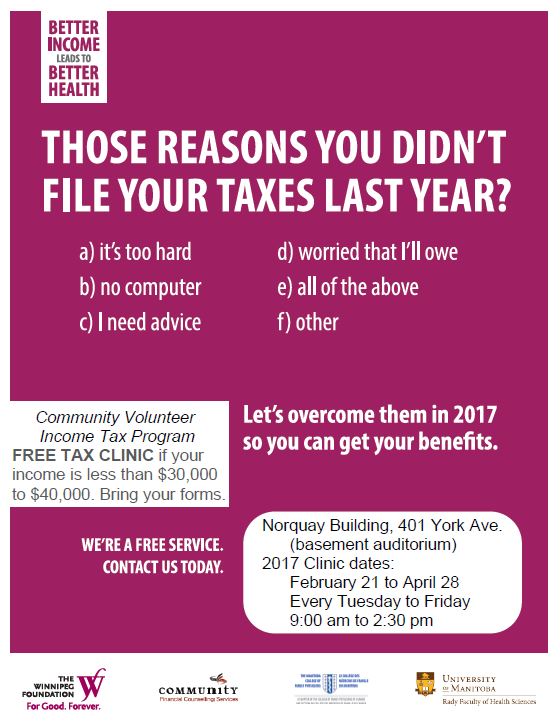

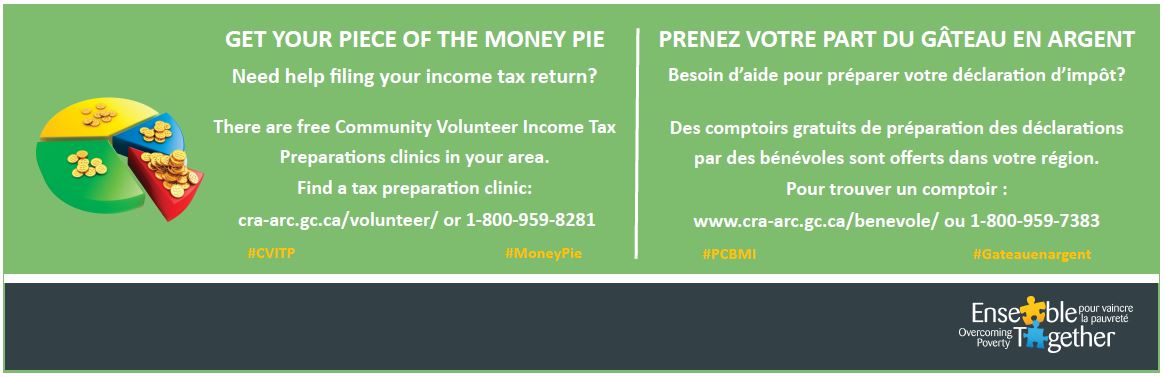

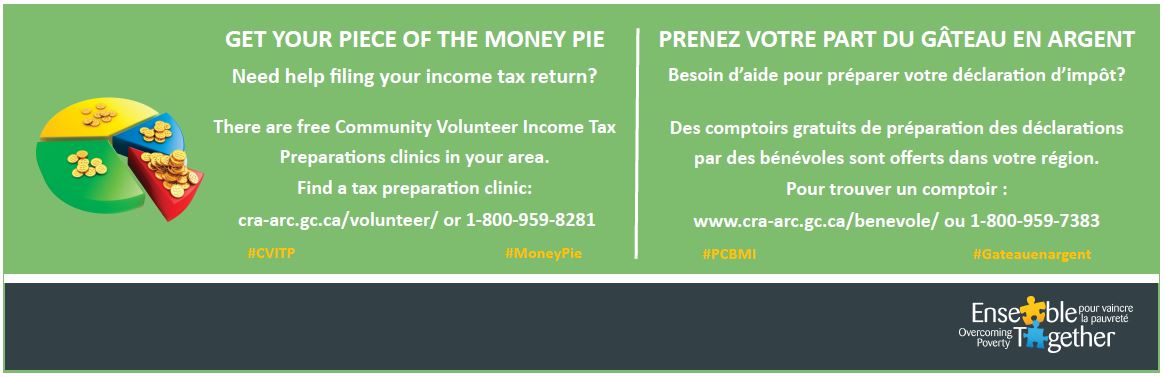

The Super Clinics have their own unique promotional campaign with purchased ads on Facebook, Twitter and through Public Service Announcements. These ads will run concurrently with the much larger, February to April advertising campaign, focusing on the Community Volunteer Income Tax Program (CVITP) which in NB is called “Get Your Piece of the Money Pie”. ESIC is using various types of marketing including: posters, inserts in a Social Development mailing, digital billboards, inside public transit posters, online through multiple media outlets, plus Facebook and Twitter.

The Super Clinics have their own unique promotional campaign with purchased ads on Facebook, Twitter and through Public Service Announcements. These ads will run concurrently with the much larger, February to April advertising campaign, focusing on the Community Volunteer Income Tax Program (CVITP) which in NB is called “Get Your Piece of the Money Pie”. ESIC is using various types of marketing including: posters, inserts in a Social Development mailing, digital billboards, inside public transit posters, online through multiple media outlets, plus Facebook and Twitter.

ESIC has also connected with our provincial partners including the Community Inclusion Networks, MP’s, MLA’s, NB Public Library Service, First Nations and other stakeholders to help promote both the Super Clinics and the overall Money Pie program. This is the largest promotional campaign and expansion of income tax clinics to date since the Money Pie project started 7 years ago in NB.

ESIC has also connected with our provincial partners including the Community Inclusion Networks, MP’s, MLA’s, NB Public Library Service, First Nations and other stakeholders to help promote both the Super Clinics and the overall Money Pie program. This is the largest promotional campaign and expansion of income tax clinics to date since the Money Pie project started 7 years ago in NB.

Follow the Get Your Piece of the Money Pie program on Facebook, Twitter, or the ESIC website and in French.

————————————————————————-

Super comptoirs du programme « Prenez votre part du gâteau en argent comptant »

La Société d’inclusion économique et sociale (SIES) fait équipe avec l’Agence du revenu du Canada et Service Canada pour tenir sept « Super comptoirs » dans le cadre du programme Prenez votre part du gâteau en argent comptant. Ces comptoirs ont pour but d’aider les Néo-Brunswickois à faible revenu à produire une déclaration de revenus, à obtenir un numéro d’assurance sociale pour leurs enfants ainsi qu’à s’inscrire au programme Bon d’études canadien, et ce, en une seule étape. Ces personnes peuvent de plus se renseigner sur d’autres programmes et prestations possibles pour leur famille, offerts par les gouvernements provincial et fédéral.

La Société d’inclusion économique et sociale (SIES) fait équipe avec l’Agence du revenu du Canada et Service Canada pour tenir sept « Super comptoirs » dans le cadre du programme Prenez votre part du gâteau en argent comptant. Ces comptoirs ont pour but d’aider les Néo-Brunswickois à faible revenu à produire une déclaration de revenus, à obtenir un numéro d’assurance sociale pour leurs enfants ainsi qu’à s’inscrire au programme Bon d’études canadien, et ce, en une seule étape. Ces personnes peuvent de plus se renseigner sur d’autres programmes et prestations possibles pour leur famille, offerts par les gouvernements provincial et fédéral.

Les super comptoirs font l’objet d’une campagne de promotion, avec des annonces diffusées sur Facebook, Twitter et par le biais de messages d’intérêt public. Ces annonces, qui seront diffusées en même temps que la campagne promotionnelle beaucoup plus étendue qui se déroulera de février à avril, portent sur le Programme communautaire des bénévoles en matière d’impôt qui, au Nouveau-Brunswick, s’appelle Prenez votre part du gâteau en argent comptant. La SIES utilise différents types d’outils promotionnels, c’est-à-dire des affiches, des encarts pour les envois postaux du ministère du Développement social, des panneaux d’affichage numériques, des affiches dans les transports en commun, des annonces en ligne par le biais de plusieurs médias, ainsi que Facebook et Twitter.

La SIES a également fait appel à ses partenaires provinciaux, c’est-à-dire les Réseaux d’inclusion communautaires, les députés fédéraux et provinciaux, le Service des bibliothèques publiques du Nouveau-Brunswick, les Premières Nations ainsi que d’autres intervenants afin de contribuer à la promotion des Super Comptoirs et du programme Prenez votre part du gâteau en argent comptant. Il s’agit de la plus importante campagne de promotion et du plus important élargissement des comptoirs de préparation de déclarations de revenus depuis la mise en place du projet il y a sept ans au Nouveau-Brunswick.

Suivez le programme Prenez votre part du gâteau en argent comptant sur Facebook, sur Twitter ou sur le site Web de la SIES et en anglais.