Guest post by EvidenceNetwork.ca: Encouraging people to file their income taxes can contribute to improved health

Filing a tax return every year allows individuals and families to unlock access to federal and provincial benefits including: Canada Child Benefit, Canada Child Disability Benefit, Working Income Tax Benefit, Manitoba Pharmacare Deductible, and more. 1 in 3 children live in poverty in Manitoba. Accessing benefits can help them and their families.

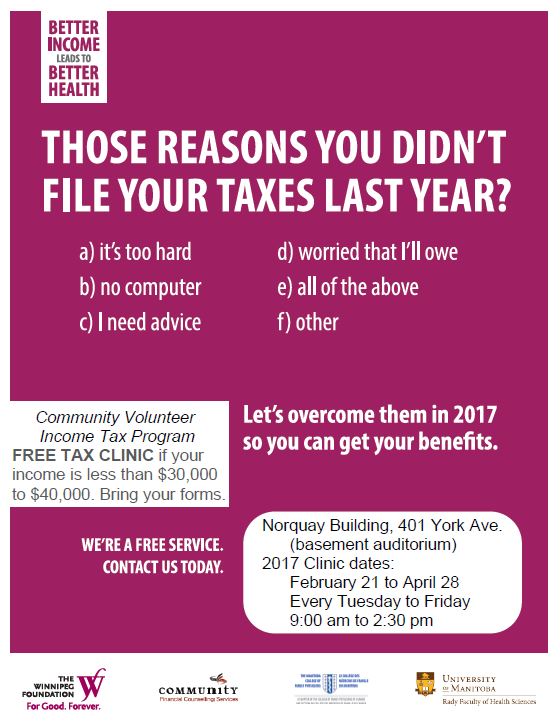

In 2016, over $23 million dollars was brought back to those living on a low income and eligible for the free income tax clinics in Winnipeg. Free clinics are available across the province too. Posters encouraging conversations with people about why and where to file taxes are being made available in different healthcare and community settings.

|

|

|

(Note: Both Those reasons you didn’t file your taxes last year? and Having trouble making ends meet? are available with editable boxes to enable you to tailor the information to your setting – either by entering the text before printing or by writing in the information by hand after printing.)

Encourage Filing Income Tax!

For more information visit www.getyourbenefits.ca

Do people need help in completing income tax forms? For help send them to Manitoba 211 – see ‘$ Financial’ on http://mb.211.ca/.

Information about free income tax clinics available in Manitoba and Winnipeg sites are listed at the Canadian Revenue Agency (CRA) website.

WRHA Community Facilitator’s have additional information about local community tax, income, and benefit resources. To contact a Community Facilitator visit their website.

By Noralou Roos, O.C., PhD

Director, EvidenceNetwork.ca

Co-Director, GetYourBenefits!, Manitoba Centre for Health Policy

Professor, Max Rady College of Medicine, Rady Faculty of Health Sciences, University of Manitoba