Filing Taxes Can Add $’000s to a Family’s Income

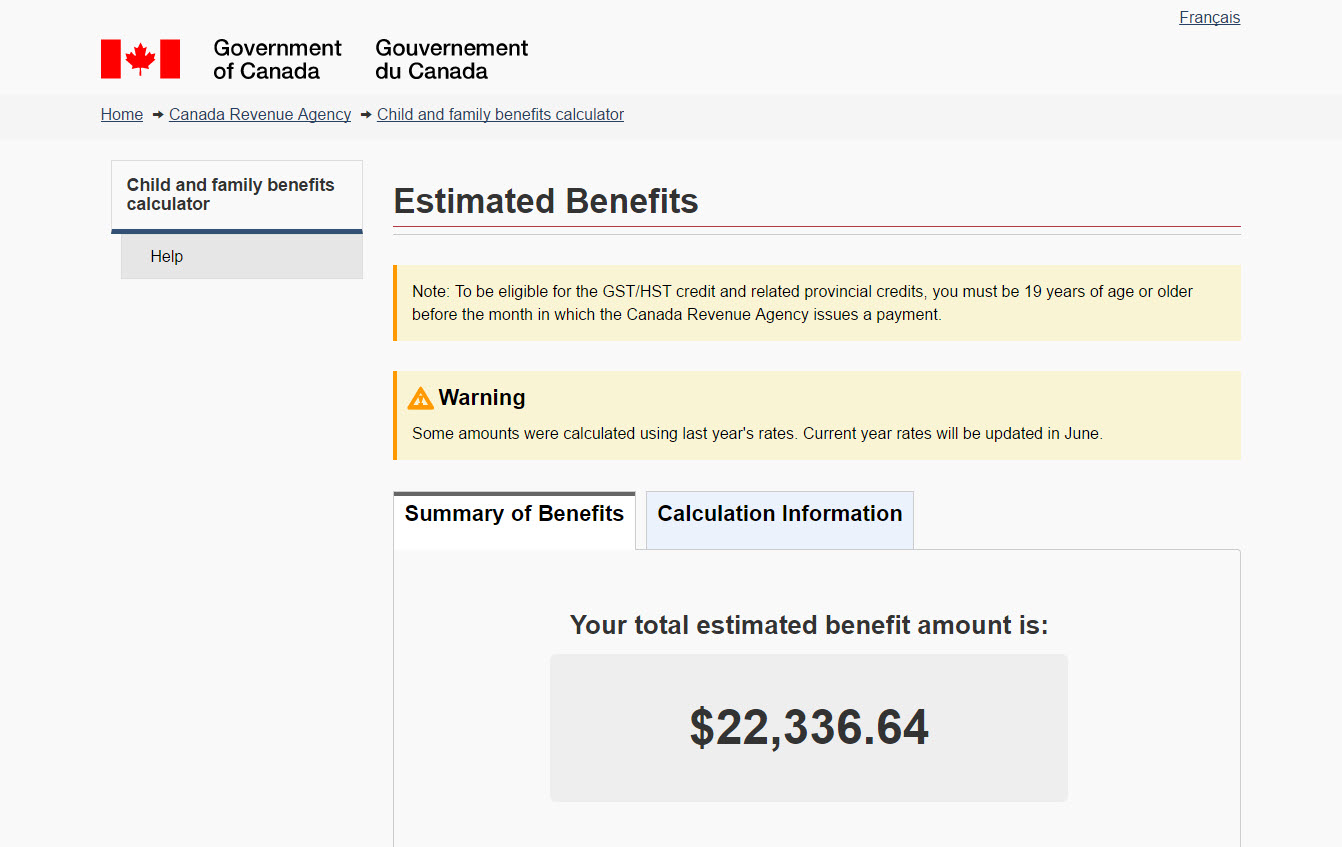

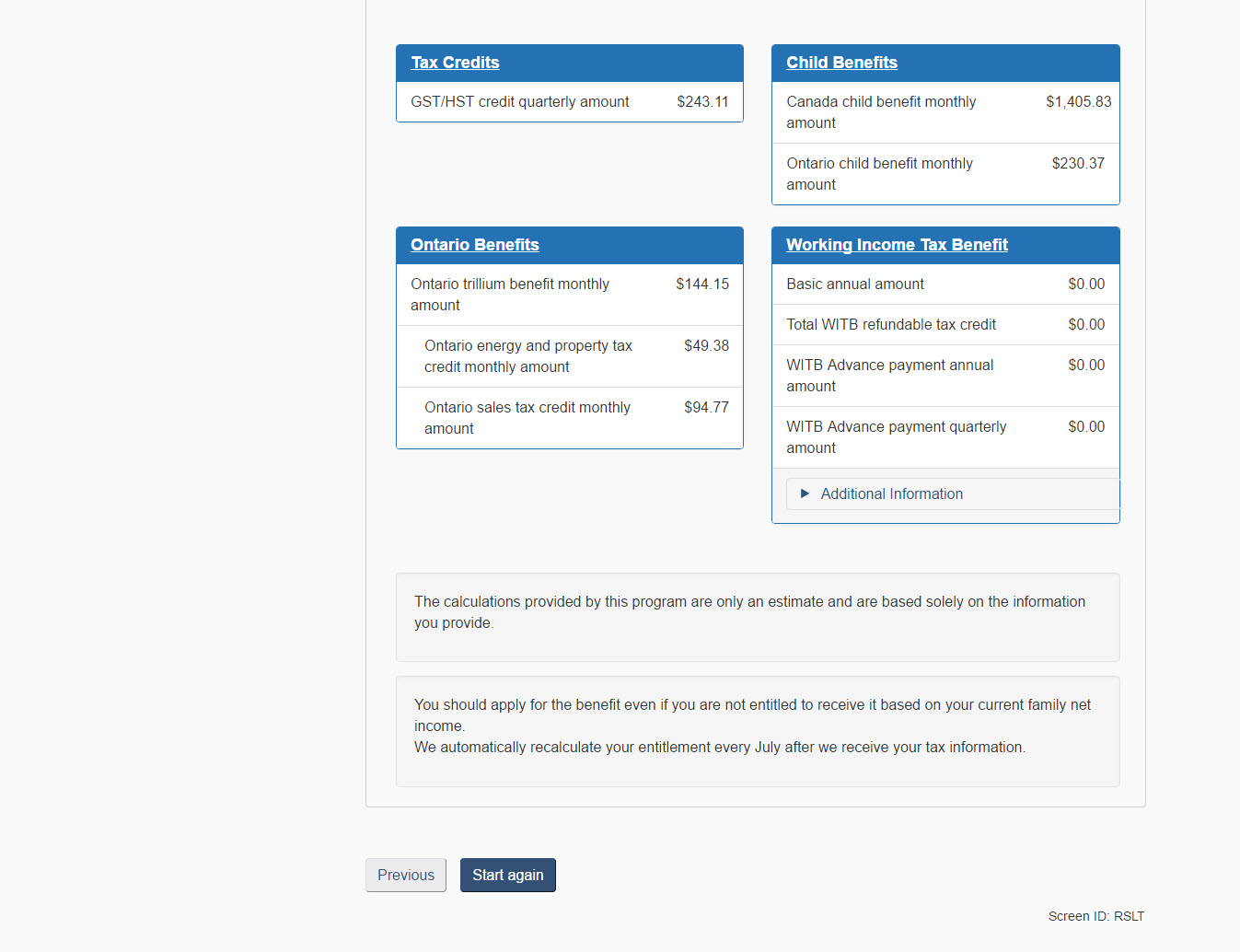

In just a few minutes, Canada Revenue Agency’s online Benefits Calculator, can show a family how much they’re eligible for in Federal and Provincial Tax Benefits…not including the Canada Learning Bonds they could receive for their children.

Christopher and Marietta (not their real names), a married couple in their 30s, live in Ontario with their three children, aged 8, 5 and 8 months old. With a net family income of $37,000, it’s a challenge to afford the $2,000 rent they pay for a two-bedroom apartment.

Using the CRA’s Benefits Calculator, they found out that filing their taxes could help them to receive over $22,000 in Federal and Provincial benefits.